What Energy Efficient Improvements Are Deductible 2019 . all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. For full details see the. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. save up to $2,000 on costs of upgrading to heat pump technology.

from www.eco-business.com

in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. For full details see the. save up to $2,000 on costs of upgrading to heat pump technology. all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034.

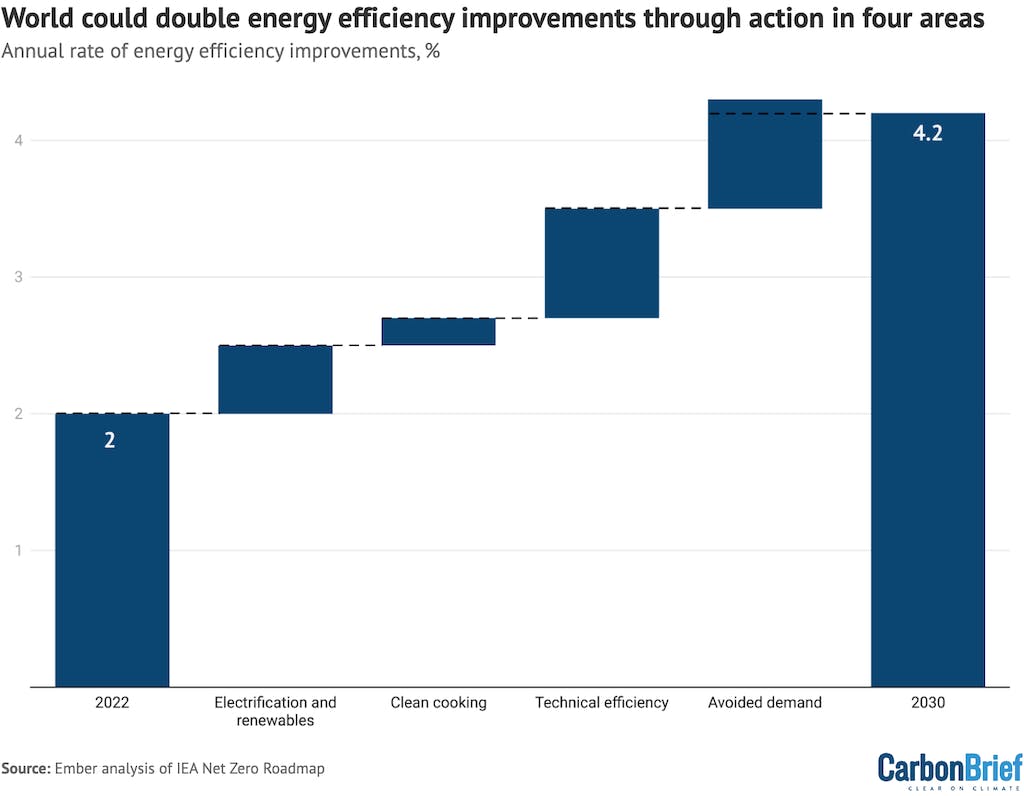

Q&A Why deals at COP28 to ‘triple renewables’ and ‘double efficiency

What Energy Efficient Improvements Are Deductible 2019 commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. For full details see the. save up to $2,000 on costs of upgrading to heat pump technology. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses.

From finerpointstax.com

Making your home energy efficient is tax deductible Finerpoints What Energy Efficient Improvements Are Deductible 2019 save up to $2,000 on costs of upgrading to heat pump technology. all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. in 2018, 2019, 2020, and 2021, an individual may claim a credit for. What Energy Efficient Improvements Are Deductible 2019.

From www.alvarezandmarsal.com

Energy Incentives §179D EPact Tax Deduction Alvarez & Marsal What Energy Efficient Improvements Are Deductible 2019 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. For full details see the. save up to $2,000 on costs of upgrading to heat pump technology. in 2018,. What Energy Efficient Improvements Are Deductible 2019.

From www.eco-business.com

Q&A Why deals at COP28 to ‘triple renewables’ and ‘double efficiency What Energy Efficient Improvements Are Deductible 2019 save up to $2,000 on costs of upgrading to heat pump technology. all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021,. What Energy Efficient Improvements Are Deductible 2019.

From www.linkedin.com

energyware™ Highlights Benefits of Energy Efficiency, Sustainability What Energy Efficient Improvements Are Deductible 2019 commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. save up to $2,000 on costs of upgrading to heat pump technology. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. in 2018, 2019, 2020, and 2021, an. What Energy Efficient Improvements Are Deductible 2019.

From genstone.com

Infographic How to Make Your Home More Energy Efficient GenStone What Energy Efficient Improvements Are Deductible 2019 save up to $2,000 on costs of upgrading to heat pump technology. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. For. What Energy Efficient Improvements Are Deductible 2019.

From www.pinterest.com

Home Energy Improvements Lead To Real Savings! Infographic Solar What Energy Efficient Improvements Are Deductible 2019 all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. save up to $2,000 on costs of upgrading to heat pump technology. For full details see the. Two tax. What Energy Efficient Improvements Are Deductible 2019.

From www.seapointe.com

Are Home Improvements Tax Deductible? Sea Pointe What Energy Efficient Improvements Are Deductible 2019 all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. save up to $2,000 on costs of upgrading to heat pump technology. For full details see the. Two tax. What Energy Efficient Improvements Are Deductible 2019.

From www.strockinsurance.com

5 Tax Deductible Home Improvements You Can Make in 2019 What Energy Efficient Improvements Are Deductible 2019 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. save up to $2,000 on costs of upgrading to heat pump technology. For full details see the. all property. What Energy Efficient Improvements Are Deductible 2019.

From www.weforum.org

What’s the state of renewable energy in 2022? World Economic Forum What Energy Efficient Improvements Are Deductible 2019 save up to $2,000 on costs of upgrading to heat pump technology. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. For full details see the. commercial building. What Energy Efficient Improvements Are Deductible 2019.

From futureentech.com

18 Home Improvement Ideas for Energy Efficiency That Will Bring Long What Energy Efficient Improvements Are Deductible 2019 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction,. What Energy Efficient Improvements Are Deductible 2019.

From neosnetworks.com

The public building 'energy efficiency' report where can improvements What Energy Efficient Improvements Are Deductible 2019 in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. save up to $2,000 on costs of upgrading to heat pump technology. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. Two. What Energy Efficient Improvements Are Deductible 2019.

From ts7smart.com

Energy Efficient Upgrades What Energy Efficient Improvements Are Deductible 2019 Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. save up to $2,000 on costs of upgrading to heat pump technology. in 2018, 2019, 2020, and 2021, an. What Energy Efficient Improvements Are Deductible 2019.

From homeimprovementtax.com

Do You Qualify for These 2022 TaxDeductible Home Improvements? Home What Energy Efficient Improvements Are Deductible 2019 save up to $2,000 on costs of upgrading to heat pump technology. all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. For full details see the. Two tax. What Energy Efficient Improvements Are Deductible 2019.

From afpkudos.com

Form 5695 Which renewable energy credits apply to the 2023 tax What Energy Efficient Improvements Are Deductible 2019 For full details see the. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. save up to $2,000 on costs of upgrading. What Energy Efficient Improvements Are Deductible 2019.

From focus.hidubai.com

45 Governments Back Ambition to Double Global Energy Efficiency What Energy Efficient Improvements Are Deductible 2019 all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. For full details see the. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1). What Energy Efficient Improvements Are Deductible 2019.

From fabalabse.com

What energy efficient improvements are taxdeductible? Leia aqui What What Energy Efficient Improvements Are Deductible 2019 all property installed meets the applicable energy efficiency and other requirements for qualifying for the energy. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of. What Energy Efficient Improvements Are Deductible 2019.

From www.gridpoint.com

New Survey on Commercial Building Energy Efficiency Combating Rising What Energy Efficient Improvements Are Deductible 2019 in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. save up to $2,000 on costs of upgrading to heat pump technology. commercial building owners that increase their energy efficiency by at least 25 percent will be able to claim a deduction, with bonuses. . What Energy Efficient Improvements Are Deductible 2019.

From celestawvalli.pages.dev

2024 Federal Tax Credits For Energy Efficient Home Improvements Jodi What Energy Efficient Improvements Are Deductible 2019 in 2018, 2019, 2020, and 2021, an individual may claim a credit for (1) 10% of the cost of qualified energy efficiency. save up to $2,000 on costs of upgrading to heat pump technology. Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034. commercial building owners that increase their energy. What Energy Efficient Improvements Are Deductible 2019.